Budgeting for personal development and education is an essential aspect of financial planning for individuals. Investing in one’s education and personal growth can lead to numerous long-term benefits, including career advancement, improved skills, and overall personal fulfillment.

By carefully allocating resources and creating a budget specifically for personal development and education, individuals can proactively pursue their goals and aspirations while maintaining financial stability.

With these tips, you can create a solid financial foundation that supports your aspirations and empowers you to reach new heights.

Set Clear Goals

To effectively budget for personal development and education, it’s important to set clear and achievable goals. Setting goals gives you a sense of direction and purpose, allowing you to focus on what truly matters to you.

When it comes to goal-setting strategies, it’s crucial to be specific and break your goals down into smaller, manageable steps. This helps you track your progress and stay motivated along the way.

Accountability also plays a vital role in achieving your goals. By holding yourself accountable, you’re more likely to stay committed and follow through with your plans.

One way to ensure accountability is by sharing your goals with someone you trust, like a friend or family member. This not only provides support but also creates a sense of responsibility to follow through.

Setting deadlines for your goals is another effective strategy. Deadlines create a sense of urgency and help you prioritize your time and resources accordingly. Breaking your goals down into smaller, short-term milestones can make them feel more attainable and less overwhelming.

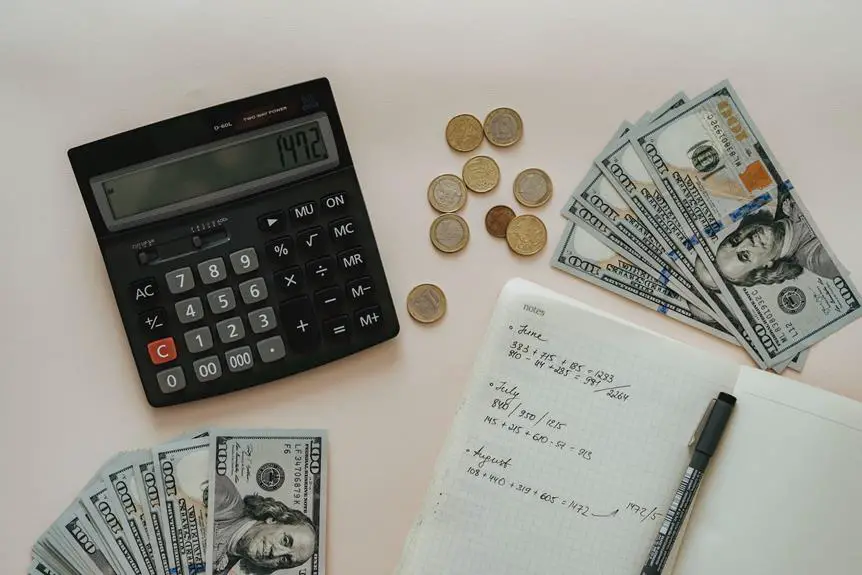

Assess Your Current Finances

Let’s start by assessing your current financial situation. Take some time to gather all your financial documents, such as bank statements, bills, and credit card statements. This will give you a clear picture of your income and expenses.

Once you have your documents, take a close look at your monthly income and expenses. Be thorough and include everything from rent or mortgage payments to utility bills and groceries. This will help you understand where your money is going each month.

Now that you have a better understanding of your financial situation, it’s time to create a savings plan. Set specific savings goals that align with your personal development and education goals. Determine how much you want to save each month and allocate that amount towards your goals.

Remember to be realistic with your savings plan and adjust it as needed. It’s important to track your progress regularly and make any necessary changes to ensure you stay on track.

Prioritize Your Expenses

Start by determining which expenses are essential and prioritize them to effectively manage your finances. Prioritizing your needs is a crucial part of financial planning, especially when it comes to personal development and education.

When you have limited resources, it becomes important to allocate your money wisely to ensure that you can cover your essential expenses first.

To prioritize your expenses, begin by making a list of your needs versus wants. Your needs are the essential expenses necessary for your survival and well-being, such as rent, utilities, food, and transportation.

On the other hand, wants are expenses that aren’t essential but are nice to have, such as dining out entertainment, or luxury items.

Once you have identified your essential expenses, allocate a portion of your income towards them. This will help ensure that your basic needs are met before spending on non-essential items. It may also be helpful to set aside a specific amount for savings or emergencies to provide a safety net for unexpected expenses.

Track Your Spending

Once you’ve prioritized your expenses, the next step in effectively managing your finances for personal development and education is to track your spending. Tracking your spending is crucial for achieving your financial goals and reducing unnecessary expenses.

To reduce expenses, start by analyzing your spending patterns. Take a look at your monthly bills and identify any recurring expenses that aren’t essential. Are there any subscriptions or memberships that you no longer use?

Another way to reduce expenses is by creating a budget and sticking to it. Set limits for each spending category, such as groceries, entertainment, and transportation. By tracking your expenses against your budget, you can easily see if you’re overspending in any area and make adjustments accordingly.

Tracking your expenses is important because it provides accountability. It allows you to see if you’re making progress toward your financial goals or if you need to make changes to your spending habits.

By being aware of your spending patterns, you can make informed decisions about where to allocate your money and ensure that it aligns with your personal development and education goals.

Create a Realistic Budget

Creating a realistic budget is essential for effectively managing your finances for personal development and education. A realistic budget will help you stay on track and make progress toward your personal growth goals.

Let’s explore three practical budgeting strategies:

- Prioritize your expenses: Take the time to evaluate your expenses and determine which ones are necessary for your personal development and education. Focus on allocating your budget towards these priorities and reduce spending on non-essential items.

- Set achievable savings goals: Saving money is a crucial part of budgeting for personal growth. Set realistic savings goals that align with your financial situation and allow you to make progress toward your education and personal development objectives.

- Leave room for flexibility: Life is unpredictable, and unexpected expenses may arise. It’s important to have some flexibility in your budget to handle these unforeseen costs without derailing your progress.

By following these strategies, you can create a budget that’s tailored to your personal growth needs and helps you achieve your goals.

Cut Back on Unnecessary Expenses

Are you spending money on unnecessary expenses that could be better allocated toward your personal development and education goals? It’s time to take a closer look at your spending habits and find ways to cut back on non-essential spending.

For example, instead of eating out at restaurants frequently, you could start preparing meals at home. By making small changes like this, you can save money and have more funds available to invest in your future growth and learning.

Explore Free or Low-Cost Learning Opportunities

Start exploring free or affordable learning opportunities to enhance your personal development and education. Consider these options:

- Online courses: Many reputable websites offer free or affordable online courses on various subjects. Platforms like Coursera, Udemy, and Khan Academy provide access to high-quality educational content that can help you expand your knowledge and skills without breaking the bank.

- Networking opportunities: Attend local events, workshops, or meetups related to your field of interest. These gatherings often provide valuable chances to connect with like-minded individuals, industry professionals, and experts who can offer insights and guidance. Building a strong network can open doors to new learning opportunities, mentorship, and potential collaborations.

- Volunteer work: Consider volunteering for organizations or projects that align with your interests and goals. Not only will you contribute to a meaningful cause, but you can also gain hands-on experience, learn new skills, and expand your network. Many volunteer positions offer training and educational resources to support your personal development.

Utilize Online Resources and Courses

Take advantage of online resources and courses to enhance your personal development and education. With the rise of e-learning platforms and the convenience of self-paced learning, you now have access to a wide range of virtual classrooms and educational websites.

Whether you’re interested in acquiring new skills, earning certifications, or attending virtual workshops, the online world offers endless growth opportunities.

Distance learning has become increasingly popular, allowing you to study at your own pace from the comfort of your own home. Online courses cover a diverse range of subjects, from coding and graphic design to business management and foreign languages.

These courses often provide online certifications upon completion, adding value to your resume and demonstrating your commitment to lifelong learning.

In addition to online courses, there are also various educational apps available that provide interactive learning experiences. These apps offer engaging content and quizzes to help you reinforce your knowledge and track your progress.

Furthermore, digital learning communities have emerged, connecting individuals with similar interests and goals. These communities provide a supportive environment where you can interact with like-minded individuals and exchange ideas and resources.

Look for Scholarships or Grants

Consider exploring scholarship and grant opportunities to support your personal development and education goals. Scholarships and grants can provide financial assistance and help alleviate the burden of tuition fees and other educational expenses.

Here are some reasons why you should look for scholarship opportunities and financial aid options:

- Access to Funding: Scholarships and grants offer a way to access funding for your education that you may not have otherwise been able to afford. They can help cover the costs of tuition, textbooks, and other educational expenses, allowing you to focus on your studies without worrying about financial constraints.

- Recognition and Validation: Receiving a scholarship or grant can be a testament to your hard work, dedication, and achievements. It shows that your abilities and potential are recognized and validated, boosting your self-esteem and confidence.

- Expanded Opportunities: Scholarships and grants can open doors to new opportunities that may not have been available to you otherwise. They can provide access to specialized programs, internships, or study abroad experiences, enhancing your personal and professional growth.

Consider Second-Hand or Borrowing Options

Exploring second-hand or borrowing options can be a cost-effective way to support your personal development and education goals.

When it comes to purchasing textbooks, consider buying second-hand. Shopping for used books not only helps you save money, but also promotes sustainability by reducing waste. Many online platforms and local bookstores offer used textbooks at a fraction of the cost of new ones.

Additionally, you can borrow books from the library instead of buying them. Libraries are a great resource, offering a wide range of books, magazines, and even online databases that can support your personal and educational pursuits. Take advantage of your local library and borrow the materials you need.

Another option to consider is borrowing educational materials from friends or classmates who’ve already completed the courses you’re taking. By borrowing, you can access the resources you need without spending any money. Not only will this help you save, but it also fosters a sense of community and connection with others.

Plan for Unexpected Expenses

Planning for unexpected expenses is essential for effective budget management. Life can throw unexpected challenges at us, and being financially prepared brings peace of mind and the ability to handle emergencies with ease.

Here are some tips to help you plan for unexpected expenses:

- Build an emergency fund: Set aside a portion of your income each month specifically for emergencies. Having savings as a safety net provides financial security when unexpected expenses arise.

- Review insurance coverage: Ensure you have adequate coverage for your home, car, health, and other valuable possessions. This protects you financially in case of accidents, damage, or illness.

- Prioritize spending: When unexpected expenses occur, reassess your budget and prioritize spending. Temporarily reduce non-essential expenses to allocate funds for unexpected situations.

Save and Invest Wisely

Saving and investing wisely is crucial for achieving long-term financial goals and securing your future. It’s important to have a solid understanding of how to save and invest your money effectively. This is where financial literacy education comes in. By educating yourself on saving and investing principles, you can make informed decisions and improve your financial well-being.

To help you understand the benefits of saving and investing wisely, let’s look at the following table:

| Save Wisely | Invest Wisely |

|---|---|

| Build an emergency fund | Diversify your portfolio |

| Automate your savings | Research investment options |

| Set financial goals | Monitor and adjust investments |

Saving wisely involves setting aside money for emergencies and future expenses. By building an emergency fund, you can protect yourself from unexpected financial setbacks. Automating your savings ensures that you consistently contribute to your savings account, making it easier to achieve your financial goals.

Investing wisely involves putting your money to work for you. Diversifying your portfolio helps spread the risk and maximize potential returns. Researching investment options allows you to make informed decisions based on your financial goals and risk tolerance.

Monitoring and adjusting your investments ensures that your portfolio remains aligned with your objectives.

Find Creative Ways to Earn Extra Income

If you’re looking for ways to earn extra income, there are plenty of creative options available to you. In today’s ever-changing world, it’s important to think outside the box and explore innovative side hustles and freelance opportunities.

Here are some ideas to help you get started:

- Monetize your hobbies: If you have a passion for photography, writing, or crafting, why not turn your hobbies into a source of income? You can sell your work online or offer your services to others.

- Utilize your skills: Take advantage of your unique skills and expertise. Whether you’re a graphic designer, coder, or consultant, there are platforms and websites where you can offer your services and connect with clients who are willing to pay.

- Rent out your assets: If you have a spare room, a car, or any other valuable asset that you don’t use frequently, consider renting it out. Platforms like Airbnb and Turo make it easy to connect with potential renters and earn money from your unused assets.

Seek Support From Family and Friends

If you want to increase your financial resources even more, don’t hesitate to ask your family and friends for support. Seeking support from loved ones can be a great way to not only receive financial assistance but also strengthen your relationships and foster a sense of belonging.

There are several effective ways to communicate with your family and friends when seeking support.

Be open and honest about your financial goals and needs. Clearly explain why you need their support. This won’t only help them understand your situation but also provide you with emotional support and encouragement.

Discuss the specific ways they can help, whether it’s through financial contributions or providing resources. This won’t only relieve some financial burden but also strengthen your relationships and create a sense of belonging.

When reaching out to your loved ones, approach the conversation with respect and gratitude. Express your appreciation for their willingness to support you and assure them that you’ll use their assistance responsibly. Your loved ones want to see you succeed and will be happy to be a part of your growth.

Stay Motivated and Consistent

Maintaining momentum and achieving personal development goals requires staying motivated and consistent in your actions. It can be challenging to stay motivated, but with the right strategies, you can find inspiration and keep pushing forward.

Here are some tips to help you stay motivated and consistent on your personal development journey:

- Set clear goals: Define what you want to achieve and break it down into smaller, manageable steps. This will give you a sense of direction and purpose.

- Understand your why: Connect with your values and passions, and remind yourself of the benefits you’ll gain from your efforts in personal development.

- Celebrate small wins: Acknowledge and celebrate your progress along the way. Recognizing your achievements, no matter how small, will boost your motivation and keep you going.

Conclusion

Effective budgeting for personal development and education requires careful planning, prioritization, and discipline. It involves setting clear financial goals, identifying areas for investment in learning and growth, and making informed decisions about how to allocate resources.

With a well-managed budget, individuals can ensure that they are continually advancing their education and personal development without compromising their financial stability.